U.S. Traded ETF Sponsors

U.S. Traded ETF Sponsors

|

|

Below is a listing of all

U.S. traded ETF sponsors with actively trading

Exchange Traded Funds. Click on the logos

to go to their web sites for more information on

their individual funds. For a complete

downloadable list of all ETFs in .csv format,

click here.

|

|

|

|

iShares

is the contribution to the world of

personal investment management from

Barclays Global Investors, the world's

largest manager of indexed investment

products.

|

|

|

|

|

|

|

State Street Global

Advisors (SSgA) is the investment

management arm of State Street

Corporation (NYSE: STT) and the largest

institutional fund manager in the world. |

|

|

|

|

|

|

|

PowerShares ETFs are

aligned with some of the leading ETF

companies as service providers,

including the American Stock Exchange

LLC, The Bank of New York, LaBranche

Structured Products LLC, Kellogg Capital

Group, Goldman Sachs & Co. and Invesco

Aim Distributors, Inc. |

|

| |

|

|

Powershares BLDRS are a family of

exchange-traded funds ("ETFs") based on

The Bank of New York ADR IndexSM,

a real-time index tracking U.S. traded

depositary receipts. Powershares BLDRS

represent a way to diversify your

institutional or retail portfolio by

investing in depositary receipts at low

expense ratios. |

|

|

|

|

HOLDRS are securities that represent

an investor’s ownership in the common

stock or ADRs of specified companies in

a particular industry, sector or group.

HOLDRS allow investors to own a

diversified group of stocks in a single

investment that is highly transparent,

liquid and efficient. |

|

|

|

|

Vanguard

ETFs range from highly targeted sectors to

international markets to broad domestic

indexes. Built on 30 years of indexing

expertise. Designed for better market

tracking. Significantly lower costs than other

ETFs. Vanguard

ETFs range from highly targeted sectors to

international markets to broad domestic

indexes. Built on 30 years of indexing

expertise. Designed for better market

tracking. Significantly lower costs than other

ETFs. |

|

|

|

Rydex Investments and sister asset

management firm Security Global

Investors are now Rydex|SGI—a forward

thinking asset management firm dedicated

to providing high quality, innovative

investment solutions across the asset

allocation spectrum to help meet

investors’ diverse and evolving needs. |

| |

|

|

The Rydex CurrencyShares products

offer investors and institutions a

convenient and cost-effective method of

gaining investment benefits similar to

that of holding foreign currencies. The

foreign currencies market is the largest

and most liquid financial market in the

world. |

|

|

|

|

First Trust®, a unit

investment trust (UIT) product line, was

created in 1974, and is currently

sponsored by First Trust Portfolios L.P.

Since 1974, approximately 2500 products

have been deposited, providing customers

all over the world with strategically

diverse investment opportunities. |

|

|

|

|

ProShares take exchange traded funds

(ETFs) to the next level, making it easy

to implement complex investment

strategies in a single trade. Like

ordinary ETFs, ProShares offer a simple

way to gain exposure to market indexes.

But ProShares also provide innovative

new ways to manage risk and enhance

return potential in your portfolios. |

|

|

|

|

|

|

WisdomTree

Investments, Inc., is a publicly traded

company specializing in the creation of

proprietary stock indices. WisdomTree

Investments is the parent company of

WisdomTree Asset Management, Inc.

WisdomTree Asset Management is

registered as an investment adviser with

the Securities and Exchange Commission

and is the investment adviser to the

WisdomTree Trust, a family of numerous

ETFs. As investment adviser, WisdomTree

Asset Management has overall

responsibility for the general

management and administration of each

fund of the Trust. |

|

|

|

|

Seeks to provide

investment returns that closely

correspond to the price and yield

performance of the Nasdaq Composite

Index. |

|

|

|

|

Founded in 1955, Van

Eck Associates Corporation was among the

first U.S. money managers helping

investors achieve greater

diversification through global

investing. |

| |

| Today the firm

continues the 50+ year tradition by

offering global investment choices in

hard assets, emerging markets, precious

metals including gold, and other

specialized asset classes. |

|

|

CLAYMORE IS NOW GUGGENHEIM

FUNDS

CLAYMORE IS NOW GUGGENHEIM

FUNDS

|

|

Guggenheim Funds Distributors, Inc.

offers strategic investment solutions

for financial advisors and their valued

clients. Committed to innovation and

client service, Guggenheim Funds often

leads its peers with creative investment

strategy solutions. |

|

|

|

|

| |

|

|

United States

Commodity Funds LLC (“USCF”), the

General Partner and manager of United

States Oil Fund, LP (“USO”), United

States Natural Gas Fund, LP (“UNG”),

United States 12 Month Oil Fund, LP

(“USL”), United States Gasoline Fund, LP

(“UGA”) and United States Heating Oil

Fund, LP (“UHN”) does not have a web

site, but instead individual web sites

for each of its five commodity based

ETFs. |

|

|

|

|

|

DBX Strategic Advisors LLC (formerly

known as XShares Advisors LLC and FW

Advisors, LLC) was created in 2006, and

is a registered investment advisor that

advises five TDX Independence

exchange-traded funds. On June 30, 2010,

DBX Strategic Advisors LLC was acquired

by Deutsche Bank.

Click here to view the press release

announcing the acquisition. |

|

|

|

|

Grail Advisors is a San

Francisco-based investment advisor

created specifically to build and

distribute Actively-Managed Exchange

Traded Funds to the global investment

community.

Known as an innovator in the

marketplace, Grail combines the features

of the ETF format with the experience of

established active investment managers

traditionally found in mutual funds and

separate accounts. |

|

|

|

|

GreenHaven Continuous

Commodity Index Fund (GCC) is an

Exchange-Traded Fund (ETF) that provides

an innovative and efficient way to

deliver broad based, diversified

commodity exposure. It aims to achieve

this by using futures contracts to track

the Continuous Commodity Index-Total

Return (CCI-TR)†. The CCI-TR is an equal

weighted index of 17 commodities plus an

additional Treasury Bill yield. |

|

|

|

|

Direxion is a pioneer

in providing sophisticated investment

solutions and helping investors optimize

their portfolio strategies. Our

multi-directional and leveraged products

offer the opportunity for investors to

effectively manage risk and returns in

all market conditions. |

|

|

|

|

The new ETF, Global

X/InterBolsa FTSE Colombia 20 ETF (GXG),

which was listed on NYSE Arca in

February, tracks the price and yield

performance of the FTSE Colombia 20

Index, a basket of the 20 most liquid

securities in the Colombian market. |

|

|

|

|

The JETS Dow Jones Islamic Market

International Index Fund is an

Exchange-Traded Fund (ETF) that seeks

performance results which, before fees

and expenses, correspond generally to

the price and yield performance of a

benchmark index that measures the

investment return of Shari'ah compliant

securities |

|

|

|

|

We believe Emerging Global Shares

will represent the next wave of

innovation in the highly evolving world

of investing and exchange traded funds

(ETFs). In particular, our initial ETF

family offering will seek to combine the

benefits of sector based exposures with

the rising powers that are the emerging

markets. |

|

|

|

|

ETF Securities, Europe's leading

provider of commodity exchange traded

products, enters the US market. |

|

|

|

|

ELEMENTS are exchange-traded notes

designed to track the return of a

specific underlying market measure.

ELEMENTS provide convenient access to

markets and strategies that may not be

readily available to individual

investors. |

|

|

|

|

Weighting by REVENUE (as opposed to

MARKET CAPITALIZATION) can be a less

volatile, and potentially more rewarding

way to leverage the stocks in an index

like the S&P 500®. |

|

|

|

|

AdvisorShares ETFs offer operational

and tax efficiencies, which lower

investment expenses and typically

improve the overall investment return.

ETFs are, however, subject to commission

costs each time you buy or sell. |

|

|

|

|

At Jefferies Asset Management, LLC

(JAM), our goal is to provide investors

with a diversified suite of high quality

asset management products based upon a

deep understanding of the markets

developed through years of experience.

We seek to achieve attractive returns

across various strategies in all market

conditions. |

|

|

|

|

IndexIQ offers next generation

alternative investments that are liquid,

transparent, low cost and

tax-efficient.* Our ETF-based strategies

help fill an industry gap, offering

investors access to lower cost,

non-correlated investment solutions. |

|

|

|

|

|

ETF investors appreciate the

flexibility and simplicity of being able

to access important sectors of the

financial markets in a single intraday

trade. PIMCO’s ETF offerings are being

designed to provide well-engineered

solutions to a broad range of investors’

needs. |

|

|

|

|

ESGShares is the first family of ETFs

devoted exclusively to Sustainable

Investing. Sustainability is fast

becoming the economic imperative of the

21st Century global economy. Now

for the first time, there's a family of

ETFs dedicated to harvesting its

investment potential.

|

|

|

|

|

One Fund invests in a broad range of

stocks, including a diversity of

industries, size companies and

countries. By investing in One Fund, you

have the potential to gain exposure to

over 5,000 different companies in the

U.S. and around the world. This

underlying diversity in the Fund's

composition may reduce volatility and

increase the return potential for

investors. |

|

|

|

|

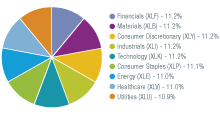

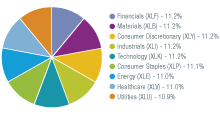

The

ALPS Equal Sector Weight ETF (Ticker

Symbol: EQL) is an ETF of ETFs that

delivers exposure to the US Large Cap

Equity market by investing equal

proportions in each of the 9 Select

Sector SPDRs. The nine Sector SPDRs are

shown in the Portfolio Composition chart

(right). The

ALPS Equal Sector Weight ETF (Ticker

Symbol: EQL) is an ETF of ETFs that

delivers exposure to the US Large Cap

Equity market by investing equal

proportions in each of the 9 Select

Sector SPDRs. The nine Sector SPDRs are

shown in the Portfolio Composition chart

(right).

|

|

|

|

|

Faith-based investing is the newest

branch of what has come to be known as

“Socially Responsible Investing” (SRI).

Faith-based investing through

FaithShares allows a person to invest in

accordance with the tenets of their

specific religious denomination

|

|

|

|

|

Teucrium Trading, LLC (Teucrium) is

the premier issuer of next-generation

commodity Exchange Traded Products

("ETP"). Teucrium designs investment

vehicles that offer liquidity,

transparency and capacity in single

commodity investing to investors and

hedgers in the popular and highly liquid

ETP format. With today’s ever-evolving

landscape in commodity markets, the

Teucrium team, with its substantial

experience in commodity futures trading,

has the ability to deliver ETPs in the

equity format for investing and hedging

without the use of leverage.

|

|

|

|

|

Schwab ETFs are designed to be core

building blocks of a diversified

portfolio. Each fund provides exposure

to a specific segment of the market,

offering low cost, trading flexibility,

and transparency.

|

|

|

|

|

Factor Advisors, a New York-based

asset management firm, announces the

launch of FactorShares, the first family

of spread exchange traded funds (ETFs)

that allow sophisticated investors to

simultaneously hold both a bull and a

bear position in one leveraged ETF.

These innovative, first-to-market

products now trade on the NYSE Arca.

|

|

|

Following is the beginning list of

sponsors outside the U.S. We will soon

provide constituent lists on many ETFs

from these sponsors. |

|

|

|

TORONTO, June 4, 2009 – Today marked

the first day of trading for BMO

Exchange Traded Funds, making BMO

Financial Group, through Jones Heward

Investment Counsel Inc., the only major

Canadian financial group to offer a

family of ETFs. |

|

|

|

|

iShares is the world’s number one ETF

provider*, managed by Barclays Global

Investors (BGI).

Offering great liquidity, deep markets

and tight spreads, iShares ETFs allow

diversified exposure into performances

of key benchmarks and asset classes

including equities, fixed income,

emerging markets, property and

alternatives.

|

|

|

|

|

Amundi ETF covers all asset classes

(equities, fixed income, money markets,

and commodities) and geographical

exposures ( Europe , US, emerging

markets, and world). As one of the

pioneers in the ETF market with its

first products launched in 2001, Amundi

ETF is characterized by its quality

products, continuous innovation, and its

low cost policy. Amundi ETF is an

expertise of the Amundi Group. Amundi

ETF has been awarded “Best Europe Equity

ETF Manager 2010” as voted by the

readers of ETF Express.

|

|

|

|

|

Deutsche Bank is a leading global

investment bank with a strong and

profitable private clients franchise. A

leader in Germany and Europe, the bank

is continuously growing. The bank

competes to be the leading global

provider of financial solutions for

demanding clients creating exceptional

value for its shareholders and people.

|

|

|

|

|

The EasyETF range is a unique offer

from BNP Paribas, benefiting from the

combined expertise and synergy of both

BNP Paribas Asset Management and BNP

Paribas Corporate & Investment Banking.

Through index management expertise,

methodical index selection and market

making capabilities, EasyETF offers

investors “the best of both worlds” with

a dynamic product range of over 60

trackers listed on 4 major European

stock exchanges: Euronext, Deutsche

Börse, Borsa Italiana and the Swiss

Exchange. It aims at giving investors

access to an ever growing variety of

asset classes (equity, bonds, real

estate, commodities, credit, money

market, Shariah compliant underlyings,

emerging markets etc.), several

thematics and diverse economic sectors

(Bank, Health, Media…) in order to allow

them to fine-tune performing asset

allocation strategies.

|

|

|

|

|

ETF Securities Ltd is a provider of

Exchange Traded Commodities (ETCs) and

Exchange Traded Funds (ETFs). ETF

Securities is independently owned is the

European market leader in ETCs. The

management of ETF Securities pioneered

the development ETCs, with the world's

first listing of an ETC, Gold Bullion

Securities in Australia and London in

2003 and then the world's first entire

ETC platform which was listed on the

London Stock Exchange in September 2006.

ETF Securities has most recently

launched the largest platform of

thematic sector ETFs in Europe providing

exposure to European firsts such as

Coal, Steel, Shipping and Nuclear Power. |

|

|

|

|

J.P.Morgan Structured Fund Management

(JPMSFM) is dedicated to creating value

by providing cutting-edge funds

solutions to their clients. JPMSFM as an

Asset Management company offers a full

range of structured funds covering a

variety of assets (ETFs, quantitative

funds, tailor-made structured funds)as

well as alternative investment funds

capabilities (funds of hedge funds).

JPMSFM has been a forerunner in the

structured funds market and has shown a

consistent growth in terms of assets

under management.

|

|

|

|

|

Lyxor Asset Management - An European

ETF market leader

Lyxor Asset Management, an 100%

subsidiary of the Société Générale

Group, manages over $114 billion (end of

April 2008), of which $38.9 billion is

via ETFs.

Lyxor has been active in the ETF market

since 2001 and is a leader in Europe,

boasting 25.19% (end of April 2008) ETF

market share.

|

|

|

|

A unique range of Exchange Traded

Funds (ETFs) from The Royal Bank of

Scotland plc is now available to UK

investors. With the simplicity,

speed and transparency of ETF investing,

you can replicate the performance of

diversified indices from both Jim Rogers

and Deutsche Borse. The indices were

specifically chosen for their ability to

offer a broader and more diversified

selection of assets in either the

emerging markets, or commodities.

Our range of Market Access ETFs are

listed on the London Stock Exchange in

GBP.

|

|

|

|

|

|

|

|

| |

Vanguard

ETFs range from highly targeted sectors to

international markets to broad domestic

indexes. Built on 30 years of indexing

expertise. Designed for better market

tracking. Significantly lower costs than other

ETFs.

Vanguard

ETFs range from highly targeted sectors to

international markets to broad domestic

indexes. Built on 30 years of indexing

expertise. Designed for better market

tracking. Significantly lower costs than other

ETFs.

The

ALPS Equal Sector Weight ETF (Ticker

Symbol: EQL) is an ETF of ETFs that

delivers exposure to the US Large Cap

Equity market by investing equal

proportions in each of the 9 Select

Sector SPDRs. The nine Sector SPDRs are

shown in the Portfolio Composition chart

(right).

The

ALPS Equal Sector Weight ETF (Ticker

Symbol: EQL) is an ETF of ETFs that

delivers exposure to the US Large Cap

Equity market by investing equal

proportions in each of the 9 Select

Sector SPDRs. The nine Sector SPDRs are

shown in the Portfolio Composition chart

(right).